This week saw the fabled Hindenburg Omen generate its first major sell signal in three years, suggesting the endless bull market of 2024 may soon indeed be ending. Why is this indicator so widely followed, and what does this confirmed signal tell us about market conditions going into Q1? First, let’s break down the conditions that led to this rare but powerful bearish indicator.

Major Tops Tend to Have Consistent Patterns

Strategist Jim Miekka created the Hindenburg Omen in 2010 after analyzing key market tops through market history. What consistent patterns and signals tended to occur leading into these market peaks? He boiled it all down to three key factors which were consistently present:

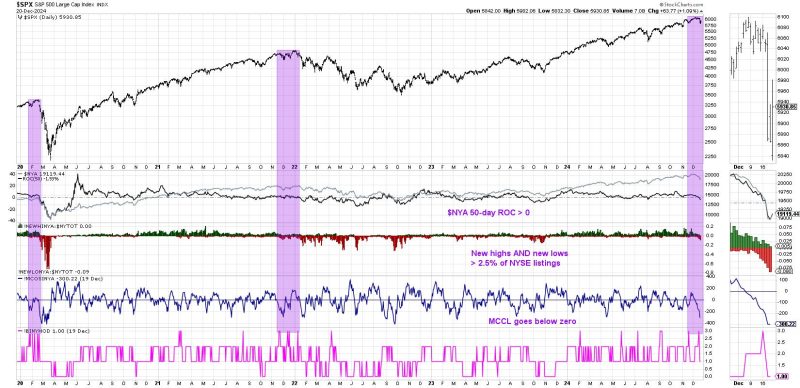

- The broad equity markets are in an uptrend

- At least 2.5% of NYSE listings are making a new 52-week high and at least 2.5% are making new 52-week lows on the same day

- The McClellan Oscillator breaks below the zero level

One final step involves observing these three conditions occur at least two times within one month. Looking at the chart, we can see that this completed Hindenburg Omen signal has only occurred three times since 2019: in February 2020, going into the COVID peak, in December 2021, just before the 2022 bear market, and in December 2024.

What strikes me about this initial look at the indicator is that from a technical perspective, 2024 and 2021 have been remarkably similar. Both years featured long-term uptrends with minimal drawdowns and low volatility. So does that mean we are heading into another 2022 and a 9-month bear market for stocks? Not necessarily.

Trend-Following Techniques Can Help Improve Accuracy

Switching to a weekly chart, we can bring in much more history to consider. I’ve added red vertical lines to indicate any time we registered a confirmed Hindenburg Omen signal with at least two observations within one month.

Reviewing some of the recent market tops, we can see that this indicator did remarkably well in identifying topping conditions in 2021, 2020, and 2018. Going back even further, you’ll notice signals around the 2007 and 2000 peaks as well. But what about all the other signals that were not followed by a major decline?

People have quipped that the Hindenburg Omen have “signalled ten out of the last five corrections,” referencing the “false alarm” signals that did not actually play out. I would argue that the key with indicators like this is to combine them with trend-following approaches, similar to how I approach bearish momentum divergences.

When I see a bearish divergence between price and RSI or observe any other leading indicators like the Hindenburg Omen flash a sell signal, it doesn’t tell me to blindly take action! What it does tell me is to be on high alert and look for signs of distribution that could serve to confirm a bearish rotation. By patiently waiting for confirmation, we can improve our success rate and take action only when the charts compel us to do so!

S&P 5850 Remains the Level to Watch

So where does that leave us in December 2024? While Wednesday’s post-Fed drop certainly represented a significant short-term distribution pattern, the longer-term trends for the S&P 500 and Nasdaq 100 are still quite constructive.

The S&P 500 broke below its 50-day moving average this week for the first time since September. And while Wednesday and Thursday both saw the SPX close below the 50-day, Friday’s rally on improved inflation data took the major equity index right back above this key short-term barometer.

SPX 5850 has been my “line in the sand” since the November pullback, and as long as price remains above this threshold, I’m inclined to consider this market innocent until proven guilty. And given the normal end-of-the-year window dressing common with money managers, I would not be surprised if the Magnificent 7 stocks and other large-cap growth names remain strong enough to keep the benchmarks in decent shape into year-end.

But indicators like the Hindenburg Omen certainly have caused me to dust off the bull market top checklist, looking for signs of distribution that would imply further weakness. One of my mentors and long-time StockCharts contributor Greg Morris once quipped, “All new highs are bullish… except the last one.” I’m wondering if that early December high around 6100 may be the last one for a while!

One last thing…

I recently sat down virtually with author and technical analyst Chris Vermeulen to discuss the benefits of following asset flows, the dangers of holding dividend paying stocks during bear markets, how to navigate a potential breakdown in crude oil and energy stocks, and how investing and surfing are more alike than you might think!

RR#6,

Dave

PS- Ready to upgrade your investment process? Check out my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Research LLC

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.