No Changes In Top-5

At the end of the week ending 2/7, there were no changes in the top-5, but there have been some significant shifts in the bottom 5 sectors. The most notable is the Consumer Staples sector which moved from 10th to 7th and the Healthcare sector which moved from 11th to 8th. Real Estate remained unchanged at the 9th position, while Energy dropped to 10th from 7th and Materials dropped to the last position from 8th.

New Sector Lineup

- (1) Consumer Discretionary – (XLY)

- (2) Financials – (XLF)

- (3) Communication Services – (XLC)

- (4) Industrials – (XLI)

- (5) Technology – (XLK)

- (6) Utilities – (XLU)

- (10) Consumer Staples – (XLP)*

- (11) Health Care – (XLV)*

- (9) Real Estate – (XLRE)

- (7) Energy – (XLE)*

- (8) Materials – (XLB)*

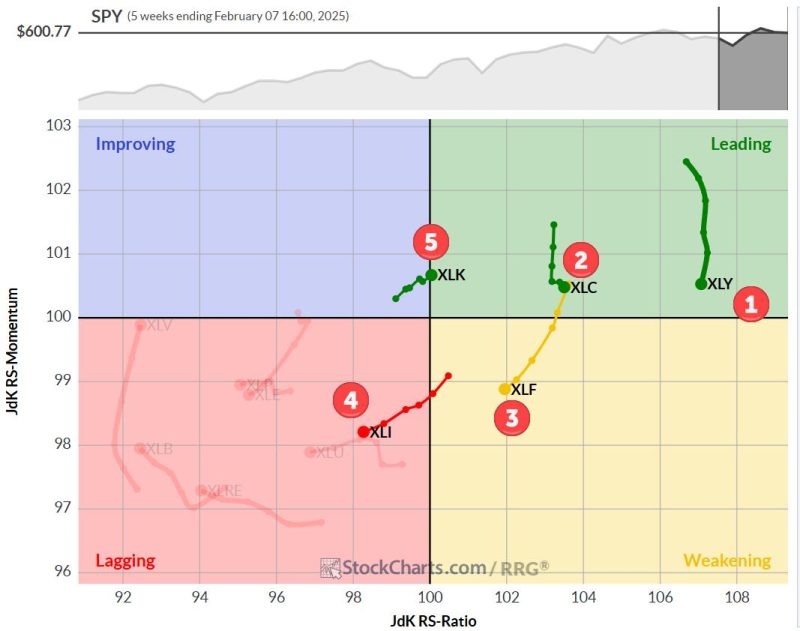

Weekly RRG

On the weekly RRG, the tails for XLY, XLC, and XLK are (still) inside the leading quadrant. XLK is just crossing over from improving. XLF is inside weakening but at a negative RRG-Heading, and XLI is moving deeper into the lagging quadrant at a negative RRG-Heading.

The most interesting observation on the RRG is that no sectors are currently positioned inside the improving quadrant. The Healthcare sector seems closest to crossing over, but, at the same time, is the sector with the lowest RS-Ratio reading.

Daily RRG

On the daily RRG, we can see why Staples and Healthcare made such big jumps. Both are pushing deeper into the leading quadrant on long tails.

Communication Services and Financials are confirming their positive outlook by continuing to move up on the RS-Ratio scale, with only a minimum loss of relative momentum so far. XLY has returned to the leading quadrant, but has already started to roll over. The positive thing for this sector is that it is all happening very close to the benchmark and on a very short tail.

Technology is the problem child on this RRG. This sector returned into the top-5 last week but is now again showing weakness on this daily RRG at the lowest RS-Ratio reading.

As I mentioned last week, the entry of XLK into the top 5 is not because of its strength but more as a result of weakness in other sectors. It’s all relative.

Consumer Discretionary

XLY is still holding above support, but last week formed a new peak. slightly lower, against the resistance offered by the mid-December peak. This makes the area between 235 and 240 an even more critical barrier now.

Important support remains located around 218. Relative strength is rolling over, but there is enough leeway for a correction after the strong move from August 2024 to now.

Communication Services

Communication Services is continuing to perform well and even managed to close higher than last week, confirming the uptrend in price. As a result, and given the weakness of other sectors and the SPY, relative strength for XLC is continuing to push the XLC tail further into the leading quadrant.

Financials

Financials also managed to put in a higher close for the week, confirming the current uptrend in price.

Relative strength has also taken out its previous high. When both price and RS can hold these trends, the RRG lines will soon turn up again and complete a leading-weakening-leading rotation, underscoring the attractiveness of the financials sector for the time being.

Industrials

Industrials did not manage to reach or take out its previous high and has now put a lower high in place. This still happening inside the rising channel, but it is not a sign of strength, so to say.

A similar thing can be said about the relative strength for XLI. With both RRG lines below a 100 and falling, the tail is being pushed further into the lagging quadrant.

Technology

The technology sector recovered well after a test of the lower boundary of its rising channel.

This is holding relative strength within the boundaries of the trading range which supports the slow improvement of the RRG lines. With RS-Ratio at 100.04, XLK has now just crossed into the leading quadrant.

Portfolio Performance

Shortly after the opening this Monday the portfolio is at a 4.01% gain vs 3.23% for SPY since the start of the year, picking up 0.78%.

Summary

The top-5 remains unchanged this week but in the bottom part of the list some noticeable changes are taking place, primarily in favor of defensive sectors like Healthcare and Consumer Staples, after Utilities already rose to the #6 position last week.

For the time being, the top-5 is still dominated by offensive sectors like XLY,XLC, and XLK. But how long will this last?

#StayAlert and have a great week. –Julius