Some Sector Reshuffling, But No New Entries/Exits

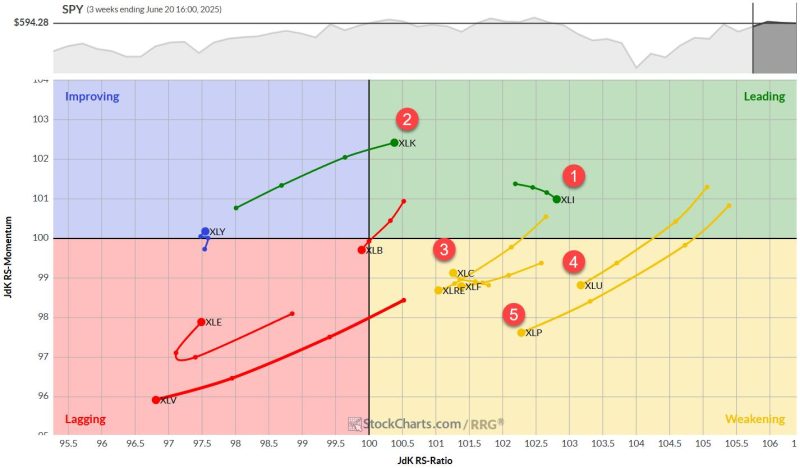

Despite a backdrop of significant geopolitical events over the weekend, the market’s reaction appears muted — at least, in European trading. As we assess the RRG best five sectors model based on last Friday’s close, we’re seeing some interesting shifts within the top performers, even as the composition of the top five remains unchanged.

The jump in Technology’s ranking is particularly noteworthy, especially when compared to Consumer Discretionary’s drop to the bottom of the list (position #11). These two sectors often move in tandem, so this divergence is worth keeping an eye on.

- (1) Industrials – (XLI)

- (5) Technology – (XLK)*

- (3) Communication Services – (XLC)

- (2) Utilities – (XLU)*

- (4) Consumer Staples – (XLP)*

- (7) Real-Estate – (XLRE)*

- (6) Financials – (XLF)*

- (8) Materials – (XLB)

- (11) Energy – (XLE)*

- (10) Healthcare – (XLV)

- (9) Consumer Discretionary – (XLY)*

Weekly RRG Analysis

On the weekly Relative Rotation Graph, the Technology sector is showing impressive strength. Its tail is well-positioned in the improving quadrant, nearly entering the leading quadrant with a strong RRG heading. This movement explains Technology’s climb back into the top ranks.

Industrials remains the only top-five sector still inside the leading quadrant on the weekly RRG. It continues to gain relative strength, moving higher on the JdK RS-Ratio axis while slightly losing relative momentum. All in all, this tail is still in good shape.

Utilities, Communication Services, and Consumer Staples are all currently in the weakening quadrant. Utilities and Staples show negative headings but maintain high RS-Ratio readings, giving them room to potentially curl back up. Communication Services is starting to curl back up toward the leading quadrant.

Daily RRG

Switching to the daily RRG, we get a more nuanced picture:

- Industrials: In the lagging quadrant with stable relative momentum, this sector needs an improvement in relative strength soon to remain in the top position.

- Technology: Almost static at a high RS-Ratio reading, indicating a stable relative uptrend.

- Communication Services: Back in the leading quadrant and still moving higher.

- Utilities and Consumer Staples: Low readings but curling back up, with Utilities already re-entering the improving quadrant.

This daily view suggests that Utilities and Consumer Staples might maintain their positions in the top five, while raising some concerns about Industrials’ short-term performance.

Industrials: Resistance Roadblock

The industrial sector is grappling with overhead resistance between 142.5 and 145. This struggle is impacting the raw relative strength line, which has rolled over, causing the RS-Momentum line to curl as well.

The RS-Ratio remains elevated and moving higher, but the resistance level is a key area to watch.

Technology: Strong Despite Struggles

XLK is facing overhead resistance in the 240 area for the third consecutive week. From a relative perspective, however, the sector looks robust. The raw RS line broke from its falling channel and is clearly moving higher, dragging both RRG lines upward and pushing XLK into the leading quadrant on the weekly RRG.

Communication Services: Balancing Act

XLC is battling resistance around 105, with its raw RS line remaining inside its channel but slowly curling up against rising support. To maintain its position, we’ll need to see either higher prices for XLC or lower prices for SPY in the coming weeks.

Utilities & Consumer Staples: Range-Bound Challenges

Both of these sectors are stuck within their respective trading ranges, causing their RRG lines to roll over. With SPY moving higher, their relative strength is under pressure, positioning both tails in the weakening quadrant on negative RRG headings.

Portfolio Performance Update

From a portfolio perspective, we’re seeing a slight improvement, but the underperformance still persists. We’re continuing to track movements and position the portfolio according to the mechanical model that is the foundation of this best five sectors series.

Looking Ahead

With no changes to the top five sector positions, we’ll be closely monitoring how this selection holds up in the coming week. The divergence between Technology and Consumer Discretionary is particularly intriguing, and the struggles with overhead resistance across several sectors could prove pivotal.

Imho, the limited market reaction to the weekend’s geopolitical events (so far) suggests a certain resilience, but we’ll need to stay alert for any delayed impacts or shifts in sentiment.

#StayAlert and have a great week ahead. –Julius