Big Moves in Sector Ranking

The ranking of US sectors continues to shift. At last week’s close, we saw another big shake-up. All defensive sectors are now in the top five. Technology dropped to last place, while Consumer Discretionary tumbled from #3 last week to #9. Within the top five, Consumer Staples gained one position, Healthcare entered at the #4 spot, and Utilities remained steady at #5.

The New Sector Lineup

- (1) Communication Services – (XLC)

- (2) Financials – (XLF)

- (4) Consumer Staples – (XLP)*

- (6) Healthcare – (XLV)*

- (5) Utilities – (XLU)

- (9) Energy – (XLE)*

- (8) Industrials – (XLI)*

- (7) Real-Estate – (XLRE)*

- (3) Consumer Discretionary – (XLY)*

- (11) Materials – (XLB)*

- (4) Technology – (XLK)*

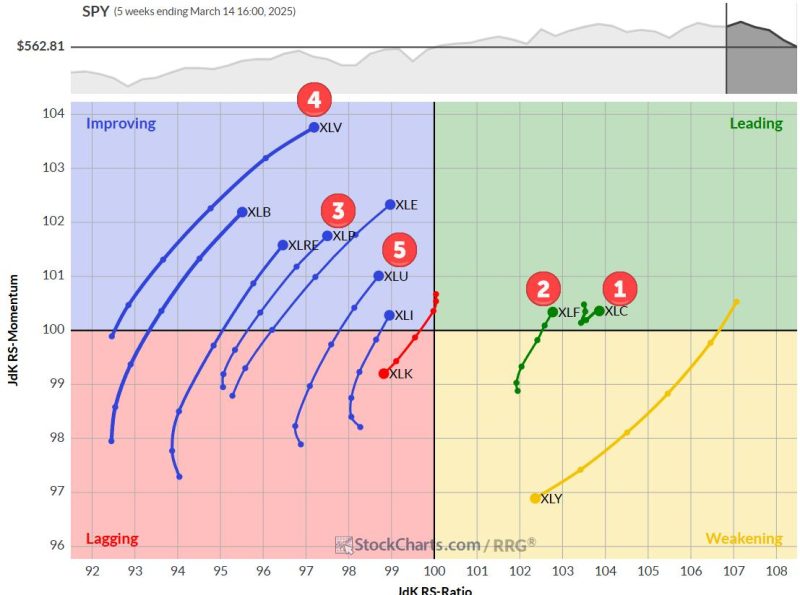

Weekly RRG: Defensive Sectors On The Rise

The weekly RRG above shows continued strength for the defensive sectors. All three—Utilities, Healthcare, and Consumer Staples—are still in the improving quadrant but show long tails and strong RRG headings.

Communication Services and Financials remain in the lead(ing quadrant) at positive RRG-Headings. However, the weakness of the Consumer Discretionary sector is starting to take its toll, and the sector dropped out of the top five while still inside the weakening quadrant.

Daily RRG: Small Losses of Relative Momentum

On the daily RRG:

- Utilities continue at a positive RRG-Heading.

- Healthcare and Consumer Staples are rolling over but still have high RS-Ratio values. Their long, improving tails on the weekly chart justify their high positions in the ranking.

- Communication Services and Financials are inside the weakening quadrant but have short tails. The high readings on the weekly RRG keep these two sectors at the top of the list.

Communication Services

XLC bounced off its lows last week and remains above the rising support line.

Relative Strength continues to improve, keeping this sector high in the ranking.

Financials

XLF also bounced off support, but the formation remains one with “toppy” characteristics.

Relative strength, on the other hand, remains strong which keeps this sector at the #2 position in the top five.

Consumer Staples

Last week, XLP completed a nasty outside bar, bearish engulfing in candlestick terms. The week’s low almost touched the support level near 78 and then bounced slightly. XLP should not break this support level to maintain a positive price outlook.

The RS-Line remains in the process of slowly turning the long-term downtrend around. The RRG-Lines are still both pointing upward, putting the tail on a positive RRG-Heading.

Healthcare

XLV entered the top five based on its turnaround in relative strength. The sharp upward move in both RRG lines positions the sector inside the improving quadrant.

From a price perspective, a trading range seems to be emerging between 135 and 150.

Utilities

XLU remains stable in its trading range, in terms of price and relative strength.

Portfolio Performance Update

The Consumer Discretionary position was closed against the open price at the opening this Monday.

Due to the price changes in the other positions, I had to do a bit of rebalancing to get everything back in line to (around) 20% of the portfolio. This meant selling small parts of Utilities, Financials, and Communication services to finance the purchase of the new Healthcare position.

Due to the big decline in XLY, and XLK the week before that, the performance of the portfolio is now 0.7% behind SPY since inception. RRG portfolio is at -4%, while SPY is at -3.3%.

#StayAlert, -Julius